As climate change casts a long shadow over our planet, a silent revolution is brewing within the financial world: Green Banking. This movement transcends mere profit margins, pushing financial institutions to embrace environmental responsibility and pave the way for a sustainable future. But what exactly is Green Banking, and how is it changing the game?

Green Banking encompasses a holistic approach to financial services, weaving environmental considerations into every aspect of its operations. From internal practices like reducing paper usage and powering offices with renewable energy to external strategies like offering green loans and supporting sustainable businesses, it’s about aligning financial decisions with ecological well-being.

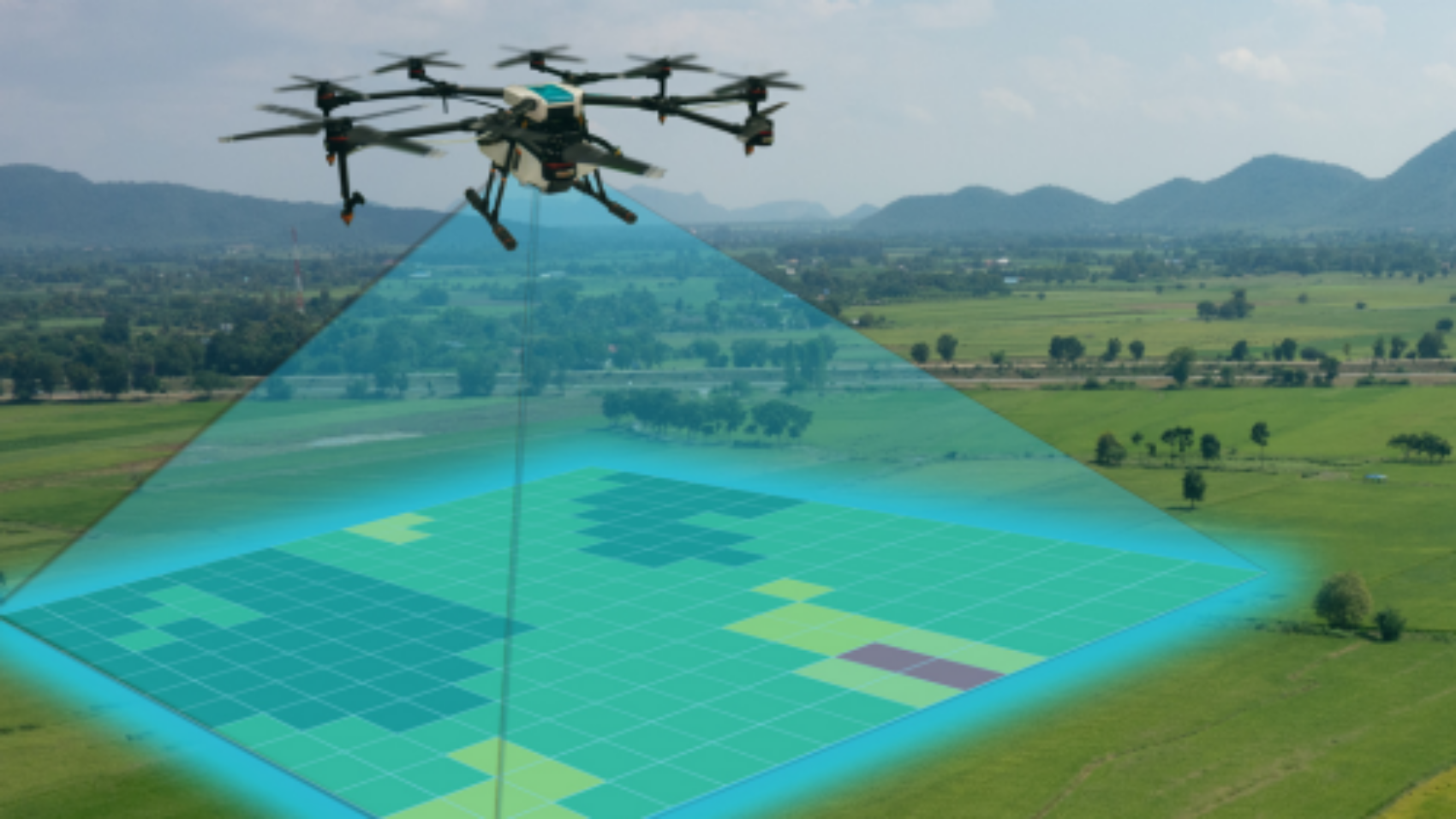

One of the cornerstones of Green Banking is green financing. Imagine banks acting as eco-conscious matchmakers, channeling investments towards renewable energy projects, green infrastructure development, and sustainable farming practices. These “green loans” not only benefit the environment but also offer investors attractive returns, creating a win-win scenario for both the planet and the bottom line. The numbers speak for themselves: the global Green Finance market is expected to reach a staggering $31 trillion by 2025, growing at a CAGR of 25.7%. Globally green bond issuance topped more than half a trillion dollars in the first six months of 2023, issuance from corporates and governments rose 18.6% compared to the same period in 2022.

Green Banking is about cultivating a sustainable future where financial success thrives alongside environmental well-being. The ripples of this movement extend far beyond reducing carbon footprints, offering a rich harvest of economic and social benefits.

Economic bounties :

Job growth: Green technologies often require specialized skills, fostering the creation of new green jobs in fields like renewable energy, energy efficiency, and sustainable agriculture. For example, a study by the International Labour Organization estimates that transitioning to a low-carbon economy could create 24 million new jobs globally by 2030. A recent study by the World Bank estimates that Green Banking can create upwards of 60 million new jobs globally by 2030, a significant boost to sustainable economic development.

Enhanced Competitiveness: Investing in green technologies and adopting sustainable practices can reduce operational costs for businesses, making them more competitive in the long run. In India, the Bank of Baroda’s green loan program helped a textile company significantly cut its energy consumption and water usage, leading to increased profitability

Financial stability: Mitigating climate change risks by supporting renewable energy and adapting to climate impacts reduces vulnerabilities for financial institutions and the wider economy. For instance, Swiss bank UBS has integrated climate change considerations into its risk management framework, strengthening its resilience against potential climate-related financial threats.

Social dividends:

Improved public health: Transitioning to cleaner energy sources reduces air and water pollution, improving public health and well-being. In China, ICBC’s green bond issued in 2017 financed wind and solar power projects, estimated to avoid 1.2 million tons of carbon dioxide emissions, and significantly improve air quality in surrounding areas.

Community development: Green Banking initiatives can provide financing for local communities to invest in sustainable infrastructure, renewable energy, and eco-friendly businesses, driving economic growth and improving quality of life. For example, Citibank’s community development loans in Brazil have supported sustainable agriculture projects, empowered local farmers, and strengthened food security.

Equity and inclusion: By promoting access to green financial products and services for underserved communities, Green Banking can contribute to reducing economic inequality and fostering environmental justice. For instance, Banco Santander Mexico’s microcredit program provides loans to entrepreneurs in rural areas to invest in sustainable technologies like solar panels, empowering them and contributing to local development.

Green Banking Initiatives:

KfW Bank (Germany): Provides dedicated green loans for energy efficiency measures in homes and businesses, contributing to Germany’s ambitious climate goals.

HSBC (Global): In 2017 it pledged to provide $100 billion in sustainable financing and investment by 2025, to finance renewable energy projects and sustainable infrastructure, supporting the transition to a low-carbon economy.

Bank of America (US): Offers carbon-neutral investment options for customers, enabling them to invest in environmentally responsible companies and projects.

These are just a few examples, and the potential economic and social benefits of Green Banking are vast and diverse. As the movement continues to gain momentum, we can expect to see even more innovative initiatives that contribute to a healthier planet and a more equitable future for all.

Building a sustainable future: Green Banking isn’t just a fad; it’s the fertile ground for a future where finance blossoms in harmony with the environment. By nurturing this movement through collaboration, innovation, and responsible choices, we can ensure that the seeds of sustainability planted today bloom into a thriving forest of well-being for generations to come. Green Banking offers a unique opportunity to align financial success with environmental responsibility, ensuring a prosperous future for both people and the planet. It’s time to let this movement flourish, sprouting a sustainable financial landscape that benefits all.

Collaborations for a green banking future:

Banks and policymakers: Banks can collaborate with policymakers to develop clear, standardised regulations for green finance, incentivize green investments, and create a level playing field for sustainable businesses.

Banks and environmental NGOs: Partnerships with NGOs can provide banks with expertise in assessing the environmental impact of investments, connecting them with green project developers, and engaging in community outreach to promote environmental awareness.

Banks and technology providers: Collaboration with technology companies can accelerate the development and adoption of innovative green finance platforms, data analysis tools, and other technologies that can empower banks to operate more sustainably and profitably.

International collaboration: Sharing best practices and knowledge around Green Banking through international forums and agreements can accelerate the global transition to a sustainable financial system.

Green banking starts with you:

Greener finance isn’t a future fancy, it’s a present imperative, and we are the gardeners. Each choice we make, from the chosen bank to the food on our plates, sows a seed in the fertile soil of tomorrow. This garden needs to be cultivated with purpose, by choosing those who nurture renewables, investing in companies that cradle the planet, and embracing green travel with mindful consumption. Every seemingly small action, like supporting eco-friendly businesses, acts as a potent fertilizer for a thriving future. Financial and environmental well-being require our cultivation, and with each responsible choice, their future blooms, one action at a time. This isn’t a mere suggestion, it’s a necessity, and the power to cultivate lies within our reach.