IZB Implemented Techurate’s Digital Banking Solution with Retail and Corporate Banking Functionalities

Posted on 7th february 2022

Indo-Zambia Bank implemented Techurate’s digital banking solution offering retail and corporate banking functionalities.

Founded in 1984, Indo-Zambia Bank (IZB), is a Commercial bank headquartered in Lusaka, Zambia. The bank has maintained an impeccable and consistent record of performance under all major financial parameters in the last 36 years. Moreover, the bank has a unique shareholding pattern with the participation of two governments: the government of the Republic of Zambia through industrial development corporation and the Government of India. The bank has a presence across retail banking, corporate banking, international banking, and digital banking. IZB has a presence across 21 cities along with national branch network coverage of 34 outlets and 60 ATMS.

According to Jyothinath Sinha, Chief IT Manager at IZB, the bank was facing issues with the earlier version especially with mobile and internet banking services concerning updating, core system, and integration issues. Moreover, some of the functionalities required were not available due to the COVID-19 pandemic. Hence, the bank decided to move with a new digital banking solution. This was not an upgrade but a new implementation process. The bank initially evaluated six vendors and finalized Techurate as its digital banking solution complemented the bank’s requirement. The bank replaced the existing digital banking solution and implemented Techurate’s digital banking solution consisting of retail and corporate banking functionalities.

Implementation Process

The implementation was bank-wide and a single country roll out. The objective of the project was to implement a digital banking solution and provide omnichannel experience across the channels. Techurate commenced with the project implementation process in February 2020, post which the COVID-19 occurred. 1 resource from Techurate and a total of 3 resources were deployed. The resource from Techurate present at the bank started with the implementation process. However, due to the pandemic, the resource returned, and the implementation was carried out remotely. The bank did not face any significant issues during implementation. The implementation process was carried out as per the project plan and as expected the project went live in the first week of April 2020.

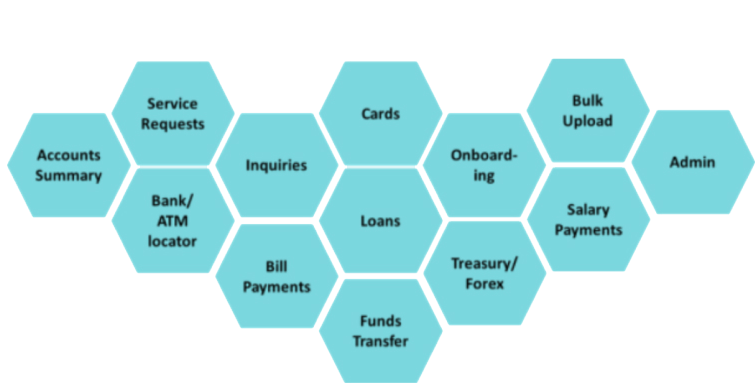

One of the new modules in this implementation includes account opening – where customers can open accounts and can reset passwords based on the tools available in the mobile banking app. The mobile banking app also enables customers to carry out local and international transactions, fund transfers, and RTGS among others that are available with a click of a button. One of the best features that the solution offers is wallet transactions. In Zambia, a lot of transactions take place using mobile money. IZB’s mobile wallet enables customers to undertake such transactions with ease. Other unique features of the mobile banking app include tax payments, schools and university payments, and utility bills, among others.

Challenges Faced

The overall implementation of Techurate’s digital banking solution was a smooth process for the bank. One of the encounters that the bank had was with third-party vendors who sometimes changed formats of the files that were to be integrated. However, with Techurate’s dynamic layer, the bank was able to adapt to the formats swiftly.

Benefits Achieved

According to Mr. Sinha, earlier the bank did not have the online account opening model and Techurate provided the bank with this model. In the earlier version of the mobile banking app, the user had to physically come to the bank branch to sign up or change in credentials. But with the new model, the users have been given the necessary details to set up their credentials. Moreover, new customers can now open accounts online. Another module known as EVS enables the bank to integrate with third parties. Earlier, the bank had to contact for services which included additional cost to the bank. However, post the implementation of the EVS module, the bank can integrate with third parties in the future with ease without incurring additional cost. Moreover, Techurate has its resources on Flexcube which is IZB’s core application. If any issue is incurred on this core system related to digital banking it is handled swiftly with quick support. Other key benefits experienced by the bank include seamless onboarding, 24*7 transfers, and payments to mobile.

“Earlier version of the app had only 3,000 active mobile users but post implementation the bank has 12,000 mobile app users. Due to the mobile wallet transaction, the bank is witnessing an increase in the number of active users with a sign off approximately 100 users per day.” – Jyothinath Sinha, Chief IT Manager, IZB.

IZB’s overall experience of working with Techurate has been remarkable. Apart from this, the overall implementation was extremely smooth. Moreover, the bank had continuous engagements with Techurate to resolve any issues. Both teams from the bank and Techurate’s side made this implementation possible in all aspects. As part of the bank’s future roadmap, they are looking for a smart cashier solution and Techurate offers this solution. Currently, the bank is the middle of finalizing internal processes to get approval for a smart cashier solution. Moreover, the bank is also planning to extend their collaboration with Techurate to fix issues with Flexcube in the core system and possibly extend their contract for another two years.